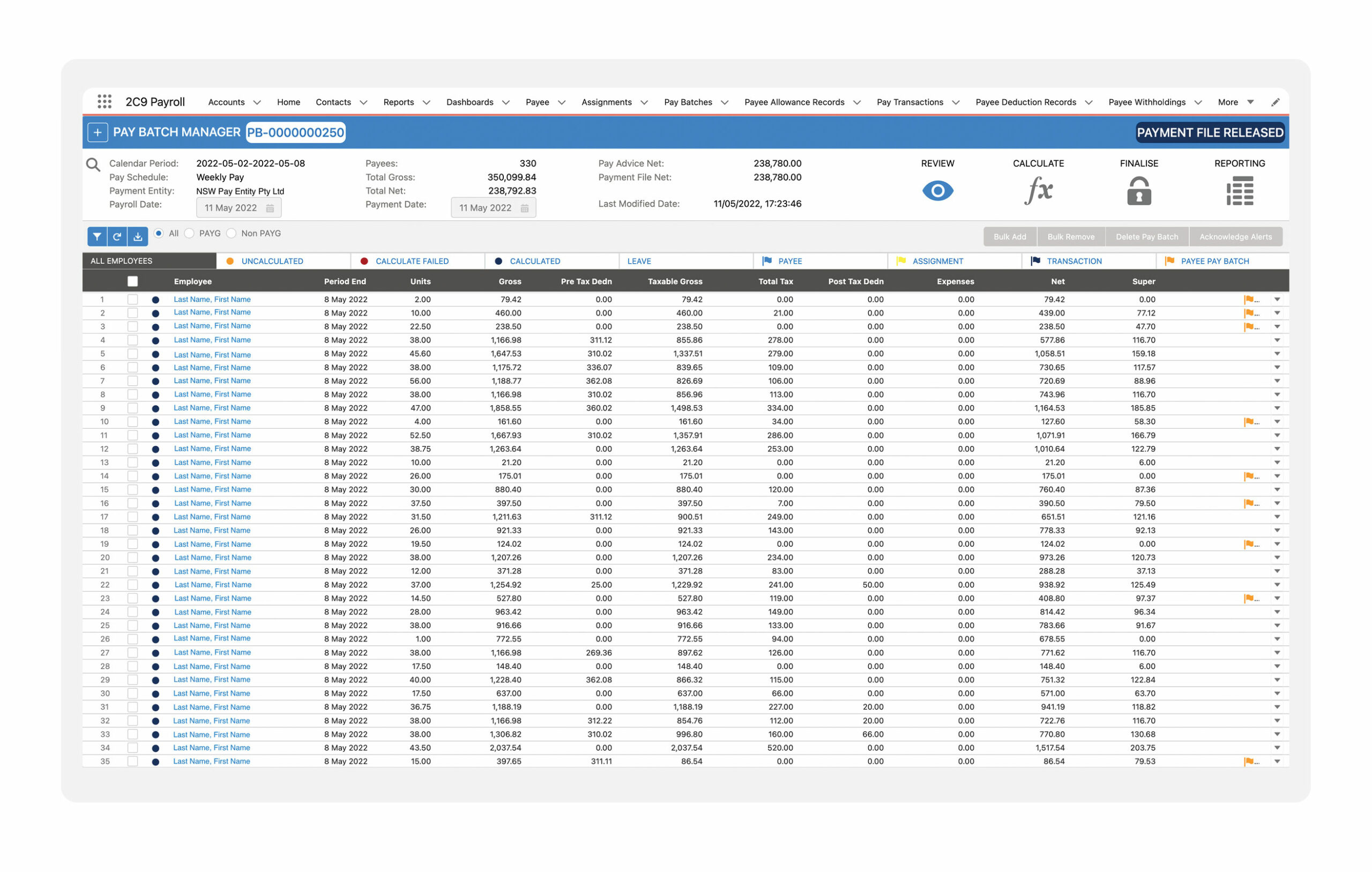

Streamline your payroll process, eliminate errors

2c9 Payroll allows you to run transactions that are efficient, reliable and correct – all in one place.

Supports multiple payment entities

We remove the need for different payroll systems, saving you time and effort. With 2c9 Payroll, you can make payments from multiple entities in one system.

Set various pay cycles

Not everyone is paid at the same time. We support multiple pay cycles, from weekly to monthly and everything in between. You can set different limits, payment dates and checks to meet the pay conditions of different payee groups.

Set pay limits and warnings

Our built-in safeguards improve payroll accuracy. Avoid overpayments and underpayments with pay limits and warnings that you can determine. Warning limits for gross pay, net pay and hours worked are included as standard.

Caters for multiple payee types

Support more than just your PAYG employees with 2c9 Payroll. You can also pay contractors, self-employed individuals and Pty Ltd companies. Handle multiple types of pay in one payroll system.

Automated pay advice

At the push of a button, our system can generate and email payslips or recipient-created tax invoices (RCTI) to your people. You can schedule the distribution, create your own email templates and apply your own branding.

Seamless onboarding

First impressions matter. 2c9 Payroll delivers a smooth onboarding process for your new team members through our online self-service portal. Your people can easily provide and update their personal information, including bank details, tax declaration, super fund selection and more.

Automated backpay calculations

2c9 Payroll automatically calculates any backpay and schedules an adjustment in the next pay cycle. This feature is available for both salary and timesheet-based employees, and calculates adjustments in super, tax and leave accruals.

Date effective payroll

We cater for any retrospective and future-dated pay rate changes, and automatically calculate and schedule the new pay. The system keeps a record of all changes, providing a complete history for every individual.

Customised leave options

Do you offer your people leave to celebrate their birthday? Perhaps you provide special leave for employee volunteering? Whatever it is, 2c9 Payroll can be customised to include any additional leave specific to your business. Minimum leave entitlements prescribed by Fair Work Australia are included as standard.

Termination calculations

We remove the need for time consuming manual calculations when it comes to paying out entitlements. 2c9 Payroll automatically and accurately determines the final pay, including leave entitlements, super and tax. Our system also allows you to complete termination scenario-based modelling and will process final pay to payroll.